If you have regular pathology tests, here is something you should know

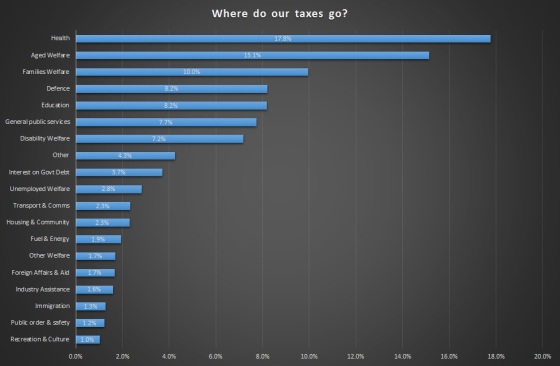

A little back story may be appropriate. In February 2015 I looked at Medicare. It was noticeable that pathology services constituted a large percentage of the total services. I doubt the proportion has dropped since. I contribute to that proportion: I have auto-immune conditions. I spend considerable time and money ensuring they are kept under control. Well, as under control as possible. I’m under the care of three specialists and a general practitioner. Every now and then extra specialists get involved, such as a skin specialist or an ophthalmologist. One of these days I’m going to have a medical party for them all.

As we all know, blood tests are very useful to medical professionals. At one stage I was having regular blood tests under Rule 3X due to the risk of possible rather nasty side effects of a drug I was on. As a patient, I don’t know the finer details of Rule 3X, but I do know it allowed me to have regular tests based on the one pathology request. Necessary in many medical situations and very useful.

At one point in time, early in my “what is wrong” phase, I happened to have medical appointments scheduled in the same week with different specialists. The week before the appointments I went into the pathology collection point with two pathology requests. I later received an invoice for one of the tests. At the time, I paid little attention. I knew my gastroenterologist had ordered a non-rebateable test at some point so assumed it was that and just paid it. As you do, in most cases.

Some time later I again had coinciding appointments and again attended the collection point with two pathology requests. All my specialists monitor my thyroid function. I was told if I had the two pathology requests done on the same day, one would not be bulk-billed. Naturally, I asked why not. Surely, I suggested, only one test was needed and then the result could simply be shared. Same blood, same day, same test. Seemed logical to me. More than that, it seemed cost-effective.

The technician was only able to advise those were the directions from head office, but she believed Medicare wouldn’t pay a second rebate on the same day. Neither should Medicare pay two rebates for the same test on the same day, I thought to myself. By this stage I had been made redundant, so time was really not a major issue, however money was, so I went on two different days to have the blood tests.

When I saw one of my specialists, I mentioned the situation to him. He was in such a state of disbelief, he called a contact within the pathology company. The conversation went something like this:

Specialist: Explains what I have described above and asks if this is correct.

Pathology: “How do you know that?”

Specialist: “Because a patient is sitting in my office telling me!”

My explanation was confirmed by the contact. However, if the specialist hand-wrote a lengthy instruction on the pathology request to share the results of duplicated requests, then they (the pathology company) would do it. My specialist, dear caring man that he is, was sure this was because they were caring for the patients, to ensure the right doctors got the right results. Rubbish, I countered, the rebates are their revenue stream. It was a light-bulb moment for the doctor. That, I said, is why I am the accountant and you are the doctor!

For a few months my appointments didn’t coincide so I really didn’t worry about it. Then the week before last, I got hammered. Now I am working and studying and driving a lot. In what little time remains I sleep, exercise – or visit doctors. As it happened, I had all three appointments close together and the way my schedule went that week I had one opportunity to get the blood tests done. Three pathology requests. Thyroid function on all three, plus some other duplicates.

I was warned I would get billed for the thyroid function test TWICE and some others singly. Wouldn’t I prefer to come back tomorrow and the next day? That is, get the three requests done on three consecutive days so all the tests could be bulk-billed. No, I wouldn’t prefer that at all, I simply do not have the time, was my somewhat irritated response. Of course the aforementioned lengthy handwritten share request was not written on any of the forms this time. Not my doctors’ fault, they shouldn’t have to do that in the first place. So I’ll be paying.

I discussed the situation with my other two specialists. One was aware of the practice and our discussions I shall keep confidential. The other crossed some tests off the new form he gave me for my next visit. We are all going to co-ordinate and share a little better!

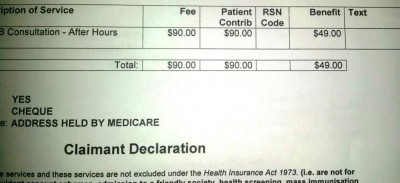

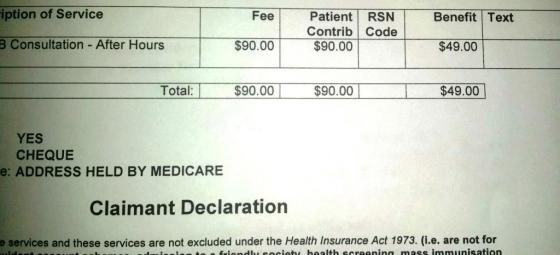

Without the operational and administrative cost details I can’t be sure, but I propose running the test once and sharing the results would be cheaper than running the test three times and generating an invoice (maybe two invoices) to me. The company may be “protecting” the revenue stream (Medicare rebates) without looking at the impact of actions on gross margin. Of course, it is a fair bet I am billed more than the Medicare rebate. When I receive the invoices I will compare.

I am told not all pathology companies operate this way, something I am going to put to the test in the coming months. After all, like many other patients, I have years ahead of me to investigate this issue! I would be interested to hear of others’ experiences.

Do you think changes should be made to the system? My specialists should not have to have a conference call to check each others’ test plans: imagine if they had to do that for many patients? I should not have to go on three separate days to have my blood tests. I specifically try to get my appointments all on the same day as this minimises disruption to other parts of my life and time off work. Consequently I am trying to have my blood tests in one hit. When it works out: if one condition flares or requires closer monitoring for a period of time, then my plans don’t work out and then the whole duplication of bloods isn’t a problem. At the moment, with everything running smoothly and in what I call “management mode” I can co-ordinate. Many other patients I am sure are in the exact same situation.

The taxpayer should not have to pay rebates for the exact same test to be performed three times on the same day. Nor should the patient.