World-leading

2015, even at this early stage, has been a year of superheated politics and partisan disagreements. Labor, along with much of the rest of Australia, has been horrified by the Government’s approach to fiscal management. The cruel and heartless policies that are the inevitable result of considering vulnerability and need as moral failings, combined with the protection and mollycoddling provided to the rich and powerful – in the Liberal worldview, the morally superior – have disenfranchised large proportions of the Australian electorate.

In return, the Coalition continues to accuse Labor of profligacy and economic vandalism, of an inability to execute on policies and an amorphous raft of conspiracy theories about union corruption. They fudge figures and misrepresent data to support their contentions. As if Australia’s struggles with productivity and international trade competitiveness were not bad enough, the Coalition chooses to repeal taxes and forgo revenue and call it “Labor’s debt trajectory” when they don’t also remove the associated spending measures. [See, for example, the comments to this article.]

Misrepresentations and political rhetoric aside, there are indisputably economic headwinds in Australia’s future.

At the core of the political wordstorm is a simple cruel fact. Australia is not globally competitive. In a globalised world of trade – the world that Tony Abbott and the government are hell-bent on plunging us into via as many free trade agreements as possible – Australia cannot compete.

Australia – Expensive one day, dirt-poor the next

Australia cannot compete on the basis of manufacturing consumer goods. There is truth to the contention that our industrial relations regime is a drag on business competitiveness. Australians have quaint ideas about fair pay, about the importance of holidays, about the necessity of workplace safety. The hard truth is that the regulations in other countries are not as rigid as they are here. Manufacturing clothes in Bangladesh, as a pertinent example, is far cheaper than making them here. Australians generally feel that sweatshop conditions of virtual slavery are inappropriate for workers and should not be supported. Most of the time, we buy the cheaper clothes anyway. Occasionally a fire in factory makes the news and prompts Australians to check the origin of their goods, but these are temporary distractions.

Australia cannot compete on the basis of services. In a world where India and China, the heavyweights amongst a multitude of other nations all struggling to match America’s prosperity, are likely to have over a billion new entrants to the middle class in the next decade or two, there will always be someone overseas happy to provide the same services an Australian could provide, and for much less remuneration. Australia’s education market is currently competitive, but this cannot be expected to last. If Australia’s status as a prosperous nation were to flag, how long would an Australian university degree remain a desirable achievement?

In a global environment, goods and services can be sold either to a domestic or an international market. The important factor to consider is the trade deficit: the imbalance between goods and services produced by Australians and sold to the international market, and the goods and services produced by international markets and sold into Australia. The trade deficit at present is historically bad – and growing worse. This is the true unsustainability in Australia’s economy.

Australia’s current economy is underpinned by the resources sector. The ‘mining boom’ might be over but resources industries and royalties still bring in a large proportion of Australia’s revenue – at the expense of skills, resources, manpower and economic support to any other part of the Australian economy. The Coalition government is well aware of the imbalance in Australia’s output, and is determined to support the mining industries just as long as anyone, anywhere, is still willing to buy the raw materials we dig up. The deleterious effects to manufacturing, to refining, to science and non-mining industry, are well known, but the Coalition’s forward thinking appears to stretch no further than one or two elections ahead.

With a chronic trade deficit, with an economy utterly reliant on mining industries where the terms of trade are deteriorating with a concomitant effect on the country’s revenue and budget position, Australia is in critical need of a differentiating benefit. Australia has little to offer the world, but Australians have plenty they want to buy from the world. That’s a recipe guaranteed, over time, to make this country the “white trash of Asia”.

Neither major party appears to have a good solution in mind for this need. Politicians mouth about Australia being the “clever country” – whilst presiding over consecutive cuts to science and technology research, removal of subsidies to innovation and cuts to schools and universities, over a long time frame. It is true that science and technology are the underpinning of a progressive and prosperous nation. Unfortunately science and technology are the easy targets for a largely ignorant populace easily turned against “ivory tower academia”.

Labor has at least espoused some piecemeal policies aimed at diversifying Australia’s economic base. Its broadband policy (the original NBN plan) was a critical national infrastructure project intended to support the internet requirements of a country in a globally-connected world. Income from the MRRT was intended for an across-the-board cut to the corporate tax rate for small to medium enterprises. Australians are ruefully aware of the fate of these policies. In their place we have ongoing subsidies to fossil fuel industries and the active efforts of senior politicians to secure international venture funding for new mining projects regardless of the environmental cost. The Coalition is fighting a rearguard effort, a vain attempt to prop up the resources industries in this country. A generous evaluation indicates that they are fully aware of Australia’s weakness in every other area of the economy; but if this is the case, a wishful-thinking approach that hopes that Australian manufacturing can recover if we only pour more resources into non-manufacturing industries seems short-sighted, at best. Without a forward-thinking plan to provide Australia a new economic base, the future appears grim.

This author would like to suggest one possible set of policy priorities that could set Australia up for a useful participation in the 21st century global economy.

One possible solution

The first thing to note is that this is unashamedly a spending policy. It has to be. The old maxim is that you cannot tax your way to prosperity (a debatable proposition at best that I have only ever heard espoused from fiscal conservatives); equally, you cannot save your way into prosperity either. Labor understands this: you need to spend – otherwise known as “investing” – in order to reap greater benefits later. The Coalition also reluctantly admits this, but their approach is to acquire the required investment funds by selling things, and then to “invest” in a hands-off manner and hope that the economy will somehow grow just because there are more roads. The Coalition has taken some baby steps in this direction but it is likely that a hands-off approach will not be sufficient.

Funds are required for every useful investment. For this proposed policy, a significant amount of funding would be required. I don’t propose here to mandate a particular way to acquire these funds. Progressives might understand the value of borrowing the required funds, but if government borrowing is too poisonous a political concept at present, then there are a multitude of ways for further revenue to be secured. Let’s just posit a slight adjustment to the levels of superannuation tax breaks, earning $10bn a year. This mid-way figure might be able to appease those who argue against the abolition of the tax breaks while still reining in some of the worst rorting of the system. $10bn p.a. would be plenty of resources to fund the Future Industries Fund.

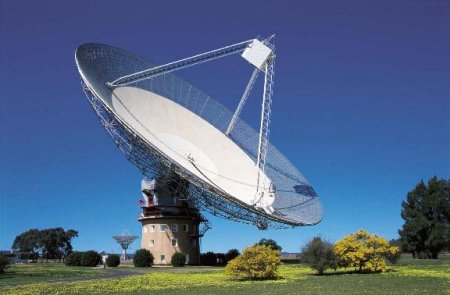

The Future Industries Fund – the FIF – would be tasked to identify and then intensively support six to ten high-value fields of scientific and technical research. These would be fields of endeavour where Australia has research capability or a natural advantage. As an example, we have almost squandered our natural advantages in the field of renewable energy: with our huge land mass, abundant sunshine and wind and low population, we have been and should be a world leader in this field. That we no longer are is a sad indictment on the policies of both sides of the spectrum. We could reclaim a world-leading position – if we wanted to.

There is the key phrase. “World-leading”. If Australia is going to compete in a global market, it needs something it can sell. That means something only Australia can or will make, or it means making something cheaper and/or better than others. We have already established that Australia cannot both make things cheaper and retain current standards of living for its people. If standard of living is a priority, we must aim to excel either by finding industries at which we can excel – such as the French making wines, or regions of Italy making shoes – or build new industries that put us ahead of the pack.

The proposed policy, the Future Industries Fund, would aim for the latter goal.

Because any spending fund is susceptible to gaming and fraud, the first priority for the FIF would be to establish an oversight group. This group would first be tasked to identify and report on the best industries for the fund to support. Renewable energy might be a logical choice – but we should not take the opinion of a blog author. Clear and firm criteria would have to be met, covering Australia’s current capability in the field, the state of each identified field in the rest of the world, and the potential for the field in creating and sustaining new saleable industries.

Having identified the areas of interest, the fund would transition to supporting scientific and technical research in these areas through a range of grants and subsidies. Obviously, this would include a re-funding of the CSIRO and of University research. Potentially, the government could take part ownership in the technologies which arose from funded research. Any revenue from this should be directed back into the FIF.

It’s not enough to be world-leading inventors and researchers. Research and development only employs a small proportion of the workforce. The FIF would also be tasked to support, again through grants and subsidies, industries that arose to capitalise on new technologies. In the hypothetical example of new solar energy technology, this would include not only the energy companies that build the solar farms, but also the artificers which build the parts for new solar energy projects; the engineering firms that build them and maintain them; the infrastructure companies that carry the energy to the people; and even the resellers that onsell the technology to the rest of the world. The FIF would also support university or TAFE courses that specialised in teaching the new technology, or provide scholarships in specific fields.

It’s not enough to establish a world-leading industry. As soon as you start selling the technology into the rest of the world, the clock starts ticking, and it will not take long before you have competitors in your market. Continued prosperity requires the FIF not to rest on its laurels. Having established an industry, an infrastructure, an educational framework, it needs to continue to support the research and technology that created it. It is necessary to keep pushing the envelope.

There would, of course, be failures. Any new scientific or technical research runs the risk of dead ends, the chance that new technologies developed would be too expensive or too difficult or too ahead of their time to be marketable. Soemtimes, financial support can address this. Renewable energy technologies used to be hugely expensive; with time and continued government support across the globe, the cost has fallen to the point that solar and wind are becoming cheaper than coal, at least in some markets. The FIF would not rely on “the market” to build a new technology up to scale; if the aim is to push the envelope then artificial support is required.

But in some cases, the technologies just might not work. It might require more funding than is worthwhile to find economies of scale. It must be accepted that sometimes a field of research initially seen as promising might turn out to be a failure. Competitors in other countries might make breakthroughs that put them years ahead of the pack and relegate FIF projects to also-rans. In such cases, the FIF must be prepared to redefine its areas of interest and write off the funding already provided.

A progressive vision

Conservatives will likely look at these proposals and choke on their tea. This proposal is for a taxpayer-funded bureaucracy with a whole raft of administrators, where research if funded with no clear business case or projected return on investment, where the government takes an active role in picking and supporting winners. All of this is anathema to the Liberal worldview. Unfortunately, we’ve seen the Liberal worldview, and we’re starting to see where it leads.

This is a simple proposal from a single blog author. There is no Treasury behind this idea. The Universities have not provided expert opinion. But if one hack author can design a set of policies intended to address the fundamental problem facing Australia’s economy, how much more could a progressive political party with the resources of government behind it achieve? I put this proposal forward for discussion. Let’s start reframing the conversation and hope that the political machine is listening.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969