Social Market Solutions: The Future of the Queensland Nickel Site

Denis Bright invites discussion about the future of the Queensland Nickel site at Yabulu, just north of Townsville in North Queensland.

As the icon of an earlier resources boom, BHP Billiton’s nickel and cobalt refinery at Yabulu, 25 kms north of Townsville entered production in 1974. Scant attention was given to the environmental protection of the adjacent savanna scrub and marine ecosystems close to Halifax Bay and the nearby Coral Sea.

The supply chain for nickel ore to the Yabulu plant from Greenvale seemed to offer twenty years of nickel and cobalt output. Imports of nickel ore commenced in 1986 to prepare for the exhaustion of local ore supplies.

Entrepreneur Alan Bond needed a commercial guarantee from the Bjelke-Petersen Government in 1973 to acquire the Greenvale nickel mine from Freeport Minerals and Metals Exploration NL operating as Daillhold Investments Pty Ltd.

Owned by Clive Palmer from 2009, the Yabulu nickel plant operated as QNI Resources Pty Ltd and QNI Metals Pty Ltd. Administrators were called in January 2016 as production losses widened during a period of over-supply in the global nickel market.

Creditors of the nickel and cobalt refinery voted to liquidate the company in April 2016. The creditors included 800 sacked workers who were left in a desperate financial position.

FTI Consulting reported on the grim details of the demands from creditors. Queensland nickel had accumulated debts of $771 million including $73 million owed to employees, $151 million to unsecured creditors and $546 million to other creditors.

But Queensland Nickel is more than a financial disaster as reported by ABC News Online on 22 April 2016. The state government estimated that cleaning-up the site would cost $93 million and rate arrears to the Townsville City Council had reached $700 000 in April 2016.

ABC News Online reported the potential environmental devastation at the Yabulu site:

Millions of litres of contaminated water are seeping from a massive dam at Clive Palmer’s north Queensland nickel refinery every day.

The seepage of more than 4 million litres of water is collected in a series of trenches and dams before being pumped back into the unlined tailings dam. (ABC News Online 18 March 2016).

The environmental sensitivity of the Yabulu nickel and cobalt refinery near the new northern beach suburbs of Townsville is obvious from the aerial photograph available through Google maps.

The Yabulu refinery on Townsville northern corridor

Adjacent to the now disused processing plant, are the vast tailing dams which can overflow during the wet season to contaminate the savanna scrub and wetlands. The size of the ponds can be estimated by the approximate scale in the aerial photograph of 1 cm to 300 metres.

The value of this 1974 vintage plant as an operational entity is highly questionable.

Securing the tailing dams must be the highest priority if the whole site is not going to be reactivated as a processing plant for nickel ores imported from distant locations through the Port of Townsville.

The nickel ore supply chain included French New Caledonia, the Philippines and potentially Indonesia as covered in the promotional video from QN in 2015 which is available on You Tube.

There is an urgent need for a senate inquiry into future options for the Yabulu nickel and cobalt refinery so that public liability for the clean-up of the site is not imposed on the Queensland government.

In a statement to ABC news on 30 June 2016, Clive Palmer claims that the plant can become operational again by March 2017 as global nickel stockpiles are declining:

“The price of nickel is moving up and the stockpile is coming down … declining by about 25,000 tonnes a month,” he said.

“By that time [March] we will be back in positive territory, and we have additional capital arrangements which we hope to inject into the business.

“We have a commitment to north Queensland. We don’t do things because they are easy, we do them because they are hard.” (ABC News Online 30 June 2016).

The resources available to a senate inquiry can fairly assess the prospects for a restoration of viable commercial operations or the options available for rehabilitation of the site if the plant is permanently closed.

If closure proves necessary, a future Queensland Catchment Management and Marine Authority within a Queensland Infrastructure Fund can supervise environmental rehabilitation of the site on a strict cost recovery basis from the administrators of remaining assets.

Some of the best equipment at the site maybe recycled in the construction of another nickel-cobalt refinery. The current Yabulu site has long outlived the twenty years projected for ore supplies from Greenvale. This helped to justify the initial BHP Billiton investment.

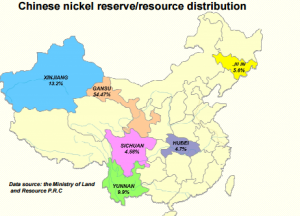

Latest projections from Bloomberg Markets indicate that the Chinese nickel industry is facing a supply shortage for nickel ore due to more humane labor controls and environmental standards in the Philippines.

This situation justifies greater Chinese interest in consolidating supplies from both Indonesia and PNG.

Chinese investment in nickel processing however could logically be in Indonesia with its lower processing costs, access to local ores and connections to low cost energy in Kalimantan (Indonesian Borneo).

Ms Wang Ye, BGRIMM Marketing Research Center 2008

Research sponsored by the School of Chemical Engineering at University of Queensland with support from both the Queensland government and the mining industry has achieved a potential 94 per cent recovery of the total value of nickel and cobalt through mixed hydroxide processing (MHP).

This Australian technology is readily available for export to Chinese processing firms who once drew on Russian technology. Such improved technology would also assist China to contain its industrial emission targets in a win-win situation for the containment of global warming.

A senate inquiry must work on the best options for the Yabulu plant as part of the sustainable economic diversification of the Townsville region which is supported by current political representatives from all three levels of government.

Options include commitment to solar energy, tourism, residential development, indigenous enterprises, improved urban water supplies for a currently drought affected Townsville, tropical agriculture and ecosystem regeneration.

Vintage solutions appropriate to the resources boom in the 1970s will have little relevance to the sustainable future of the Townsville Region.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing pragmatic public policies for a contemporary social market that is highly compatible with current globalization trends.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing pragmatic public policies for a contemporary social market that is highly compatible with current globalization trends.

10 comments

Login here Register here-

king1394 -

Harquebus -

Theresa -

Proactive Supporter -

Terry2 -

townsvilleblog -

Rubio@Coast -

Pat -

Out of the Joh Era -

Economic Diversification First

Return to home page40 years or so of production; hundreds of years for the clean-up and recovery of the land for other purposes.

Another victim to the law of diminishing returns with many more to come. Resource depletion is a one way street.

If we are going to clean up this site, we had better start thinking about all the others that are going to go belly up as well.

“continuation of current consumption rates will mean that we will have much less than 50 years left of cheap and abundant access to metal minerals, and that it will take exponentially more energy and minerals input to grow or even sustain the current extraction rate of metal minerals.”

“The quantity of rock that has to be dug up increases. For ores at half the initial grade the quantity doubles, and so does the energy needed to dig, transport and crush it.”

http://forhumanliberation.blogspot.com.au/2016/07/2371-extreme-implausibility-of.html

Denis’s article helps to define a proactive role of government in overcoming the excesses of market ideology. What’s better is the possibility of consensus building around alternatives to environmental disasters like this nickel refinery. Made in 1974 is not a way forward!

What a contrast to the to the attack on Labor values which I received in the mail recently from the local LNP state member. as a tax-payer funded mail-out.

The problem of site rehabilitation comes back to the state governments and the inadequate regulation of mine site clean-up.

The existing system of bank guarantees for site rehabilitation is fundamentally flawed in so many ways as demonstrated by this report on the dodges mining companies use to avoid site rehabilitation and cleanup costs :

https://envirojustice.org.au/sites/default/files/files/EJA_Dodging_clean_up_costs.pdf

Obviously laws State and federal must change to make the owner responsible for the clean up. This has been a disaster for Townsville in so may ways, we lost 878 jobs in total and the site has stood vacant for many months. Worst of all is Mr Palmers ignorance of Queensland Government Environment Dept had sent him many warnings to clean up his act. If the Queensland Government (the people of Queensland) have to fix this environmental disaster than the government should sue the owner into bankruptcy, he has many other valuable assets that can be sold, and he is a self proclaimed billionaire. If worst comes to worse than he should be gaoled for a few years because of his insolence. Free trade they say, it’ll be great they say, yeah right I say. Things in this country need to change for the better and soon.

What a place to build a zinc refinery right next to the Coral Sea. Who still says the market is always right! Our Malcolm it seems is still a believer and keeps his family jewels offshore in the Caymans where the tax rates are lower.

An insightful review!

I agree Terry. Site regulation for mines and refining plants favours the investors over sound environmental management. The Joh era still casts a shadow over Queensland with the support development lobby groups. This case study shows the consequences. Thanks for taking up the issue, Denis. Townsville can move on without the refinery provided the alternatives are well funded by both sides of politics.

Time for Malcolm Turnbull do do something for Townsville beyond building a football stadium